We see some electric cars here and there. Definitely not mainstream in central Jersey. You see more closer to the bigger cities. Partly due to density, and partly due to demographic and political mindset. The Prius still seems to be the most popular, but that is a hybrid – big difference.

The point is (if this is TL;DR for you), you will not save any money buying an electric car. Especially the full-electric ones. In fact, you’re probably buying a rolling death-trap more now that ever!

Don’t sweat the cost of gas {for your car}

By Eric Peters

People worried about how much money they spend on gas ought to consider how much they spend on their cars.

Gas is among their smallest expenses – especially vs. the cost of a new car. Even vs. a super-economical new car.

If saving money is the issue – rather than spending money on gas – it’s worth doing some math.

Or at least, looking at some math already done on the subject.

The American Automobile Association put together a Cost to Drive worksheet (see here) which breaks down what people pay, on average, not just for for gas – but for everything else associated with owning and driving a new car.

Emphasis on new – because people are pitched aggressively on the false idea that they will save money if they purchase one. Especially one with all the latest “gas saving” technologies.

Well – as Ronald Reagan used to say – let’s see.

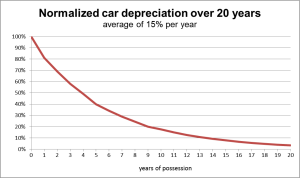

It turns out the thing which costs people the most money isn’t gas but depreciation – the hemorrhagging of value that afflicts new cars particularly.

It runs about 10 percent a year.

AAA pegs the figure at $3,000 annually, on average – which is about twice what the average person spends on gas every year, which is about $1,600 (around $32 per week).

Put another way: Even if you drive a V8 SUV that gobbles $60 in gas every week, that’s still only about $280 per month and less than the annual cost of depreciation on most new cars.

Some new cars – luxury cars – cost their owners even more in depreciation, because the value of a luxury car is bound up in its newness above everything else. A year-old luxury car is last year’s luxury car – and often worth 20 percent less than it was worth when it was new.

If you bought it for $50,000 last year and it’s worth $40,000 twelve months later, that’s a mighty big hole in your pocket – and the cash that fell through it would have bought a lot of gas.

The highest depreciating cars of all, by the way, are electric cars.

They lose bleed value even faster than luxury cars – $6,000 annually, on average according to AAA – not because of fickle things such as not being the latest things but because of functional things – aging battery packs that can’t hold as much charge as they could when new.

Which means the EV can’t go as far it could when it was new.

And because that wasn’t very far to begin with vs. a non-EV, any significant reduction in battery performance (and so of driving range) can render an EV functionally useless. Or at least, a hassle that most people aren’t interested in putting up with given how long it takes to recharge an EV.

This is why you can find three or four year old Nissan Leafs – which stickered for $30,000 when new – for $10,000 or even less on the used car market.

That is a big hit to “save on gas.”

But people often overlook the cost of depreciation because they don’t pay it in regular installments – as they do for gas. Thus they do not see it – or feel it – until it’s time to sell or trade-in their car.

Uncle uses the same principle of deceit to hide the cost of what he steals; it is called “withholding.”

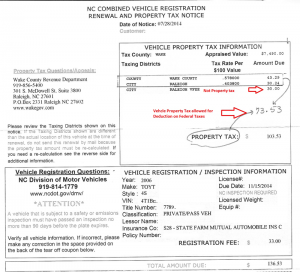

There are other costs associated with new cars that they will feel long before then, but which aren’t line items on the window sticker – and so people don’t take them into account until after they bought in.

Things like full-coverage insurance and property taxes – either of which alone can amount to as much as the average person spends on fuel every year.

It costs about $1,000 annually to full-cover a new car – the high premium a function of the high cost to fix new cars. A supermarket parking lot fender bender is actually a plastic cracker – and tearer. The exposed front and rear “fascias” of almost all modern cars look sleek but are extremely vulnerable to damage and often throw-aways rather than fix-’ems.

You replace the entire plastic front clip to deal with a rip.

Now you know why it costs you so much to cover the thing – even though you have a perfect driving record and the car has all those saaaaaaaaaaaaaaaaaaaaaaaaaafetyfeatures you thought were going to save you money.

Property taxes – in states that apply them – can cost you as much as insurance, too.

Together, they can easily cost you more than gas. Over six or seven years, what you pay in full coverage insurance and property tax could have bought you a good used car – in cash. Which would cost you half or less as much to insure and a third or less in property taxes.

The best way to save money – so you have it, to spend on gas as well as other things, like repairs costs – is to not buy a new car.

If you aren’t spending $300 a month in new car payments – plus the hidden cost of depreciation on the new car, which is almost equivalent to another $300/month – plus full coverage insurance and rapacious property tax based on the value of a new car – spending even $60 per week to fuel a “gas hog” but paid-for older SUV can save you a fortune.